Optimizing Employee Salary Structures for Maximum Benefit

Designing an effective salary structure is crucial for maximizing employee satisfaction while aligning with legal and financial considerations. Here are three key factors to keep in mind when crafting your salary structure:

1. Maximizing In-Hand Salary: The goal is to ensure employees receive the highest possible in-hand salary. A significant portion of the salary should be allocated to the Basic component, which must constitute at least 50% of the total salary as per a recent Supreme Court ruling.

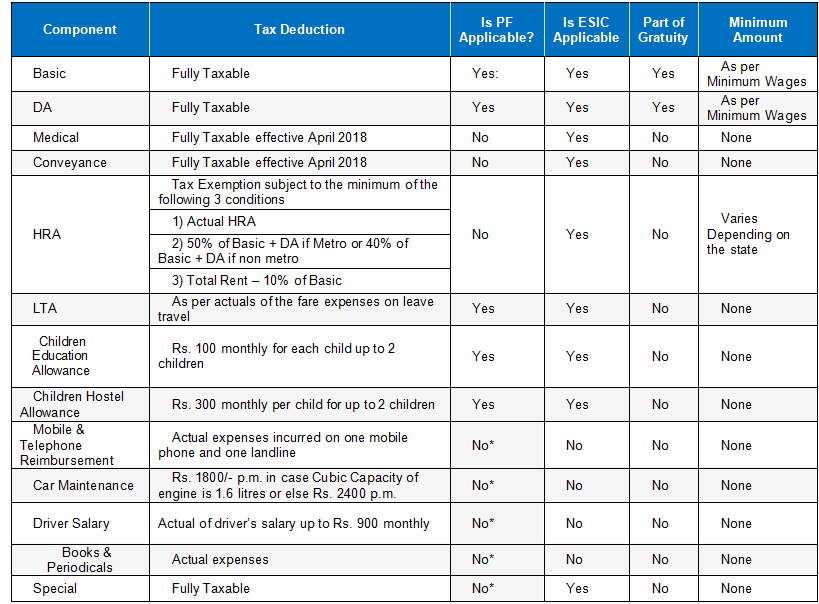

2. Enhancing Tax Benefits: Structuring salaries to maximize tax benefits is essential. The House Rent Allowance (HRA) should ideally be 40-50% of the Basic salary, depending on metro or non-metro residency.

3. Minimizing Statutory Contributions: Balancing statutory contributions like Provident Fund (PF) and Employee State Insurance (ESI) can help manage expenses while maintaining compliance.

Components of an Effective Salary Structure:

• Basic Salary: Must be at least 50% of the total salary and not below the minimum wage.

• House Rent Allowance (HRA): 40-50% of Basic salary, adjusted based on residential location.

• Food Allowance: Can be included if a food arrangement or canteen facility is available.

• Other Allowances: Industry-specific allowances like Uniform, Car, or Driver Allowance.

• Leave Travel Allowance (LTA): Allows employees to claim exemptions for travel.

• Additional Benefits: Includes LTA, Car Maintenance, Books & Periodicals, with proof submission.

Note: PF is now applicable on all heads except HRA unless allowances are variable or linked to production incentives.

By balancing these components, you can create a salary structure that optimizes in-hand salary, tax benefits, and statutory contributions, aligning with compliance requirements.

Disclaimer: These are personal views of the author, meant for educational purposes. SmartOfficePayroll.com is not responsible for the accuracy of the same.